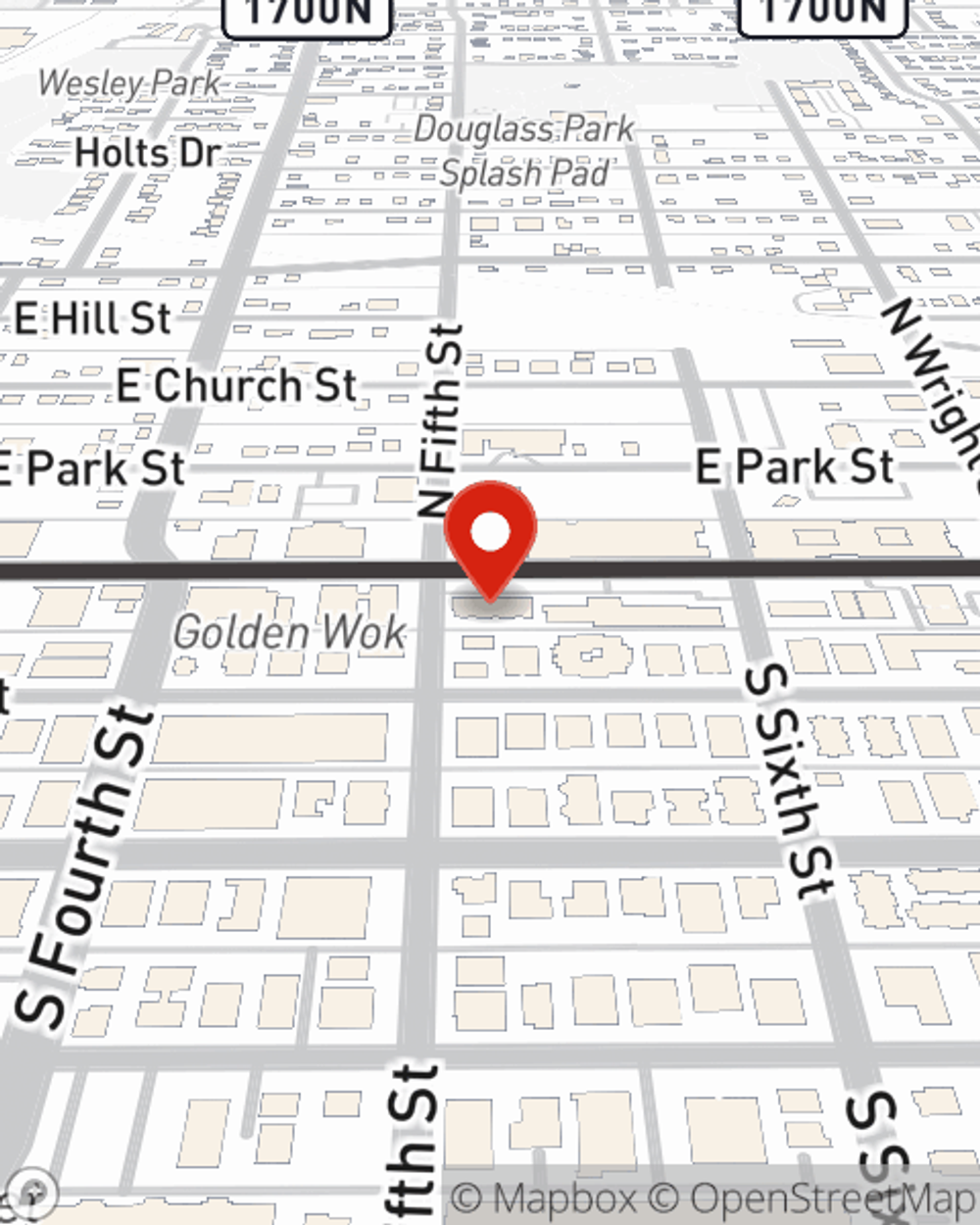

Business Insurance in and around Champaign

Looking for small business insurance coverage?

This small business insurance is not risky

- Champaign County

- Urbana

- Mahomet

- Savoy

- Danville

- Indiana

- Bloomington

- LeRoy

- Rantoul

Help Protect Your Business With State Farm.

Sometimes the unpredictable is unavoidable. It's always better to be prepared for the unfortunate accident, like a customer stumbling and falling on your business's property.

Looking for small business insurance coverage?

This small business insurance is not risky

Keep Your Business Secure

The unexpected is, well, unexpected, but that's all the more reason to be prepared. State Farm has a wide range of coverages, like extra liability or worker's compensation for your employees, that can be molded to develop a customized policy to fit your small business's needs. And when the unexpected does occur, agent John Caywood can also help you file your claim.

Take the next step of preparation and reach out to State Farm agent John Caywood's team. They're happy to help you learn more about the options that may be right for you and your small business!

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

John Caywood

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.